12-08-2025

Form 2290 | IRS Authorized E-file Provider | Simple and Fast

Filing the Heavy Vehicle Use Tax doesn’t have to feel like you’re drowning in forms anymore. With IRS-approved e-file services like Simple Form 2290, you can send off Form 2290 in just a few minutes and usually get your stamped Schedule 1 back before your coffee even has a chance to get sad and lukewarm. This little walkthrough lays out what actually matters when you’re submitting IRS Form 2290 online so you can get it done fast, keep it secure, and avoid spending more money on it than you need to.

Why e-file Form 2290 in 2025?

-

IRS requirement for many filers. If you operate 25 or more taxable vehicles, the IRS requires electronic filing. Even single-truck owner-operators, however, can benefit from faster processing.

-

Faster Schedule 1. Paper filers wait up to six weeks for a stamped Schedule 1. E-filers often receive it in less than five minutes after IRS acceptance.

-

Lower rejection risk. Modern portals validate VINs, EIN formats, weight categories, and First Used Month (FUM) entries in real time, reducing data errors the IRS flags on paper returns.

-

Proof of payment on the road. Many state DMVs and port authorities now ask for electronic Schedule 1 copies. Having it instantly on your phone avoids costly delays.

According to the IRS Statistics of Income Division, more than 86 percent of all Form 2290 returns were e-filed in the last fiscal year (source: IRS SOI Bulletin). The trend keeps climbing as truckers embrace speed and convenience.

Key traits of an IRS-authorized e-file provider

Not every website that advertises 2290 help is cleared to transmit data directly to the IRS. Before you share sensitive business information and routing numbers, confirm the platform meets three non-negotiables:

-

IRS e-file authorization. Check the public list on IRS.gov and look for an EFIN (Electronic Filing Identification Number) displayed on the provider’s site.

-

Data encryption. A-level providers use HTTPS, 256-bit SSL encryption, and separate at-rest encryption for stored records.

-

Transparent pricing. No hidden transmission or “processing” fees tacked on at checkout.

Simple Form 2290 meets each standard, is listed on the official IRS authorized e-file provider page, and charges an industry-low flat fee of USD 9.95 per truck with volume discounts for fleets.

How Simple Form 2290 makes Form 2290 filing simple and fast

The portal was built specifically for owner-operators, leased-on drivers, and fleet managers who do not have time to wrestle with government forms. Here is what the workflow looks like after you create a free account:

-

Enter business details (name, EIN, address, signing authority).

-

Add vehicles individually or upload a bulk spreadsheet. VIN verification catches typos instantly.

-

Select the First Used Month and taxable weight. The system auto-calculates HVUT so you do not open IRS tables.

-

Choose payment method (EFTPS, debit/credit card, or direct bank draft). No third-party money movement required if you prefer to pay the IRS separately.

-

Review and transmit. Built-in error check flags missing data before submission.

-

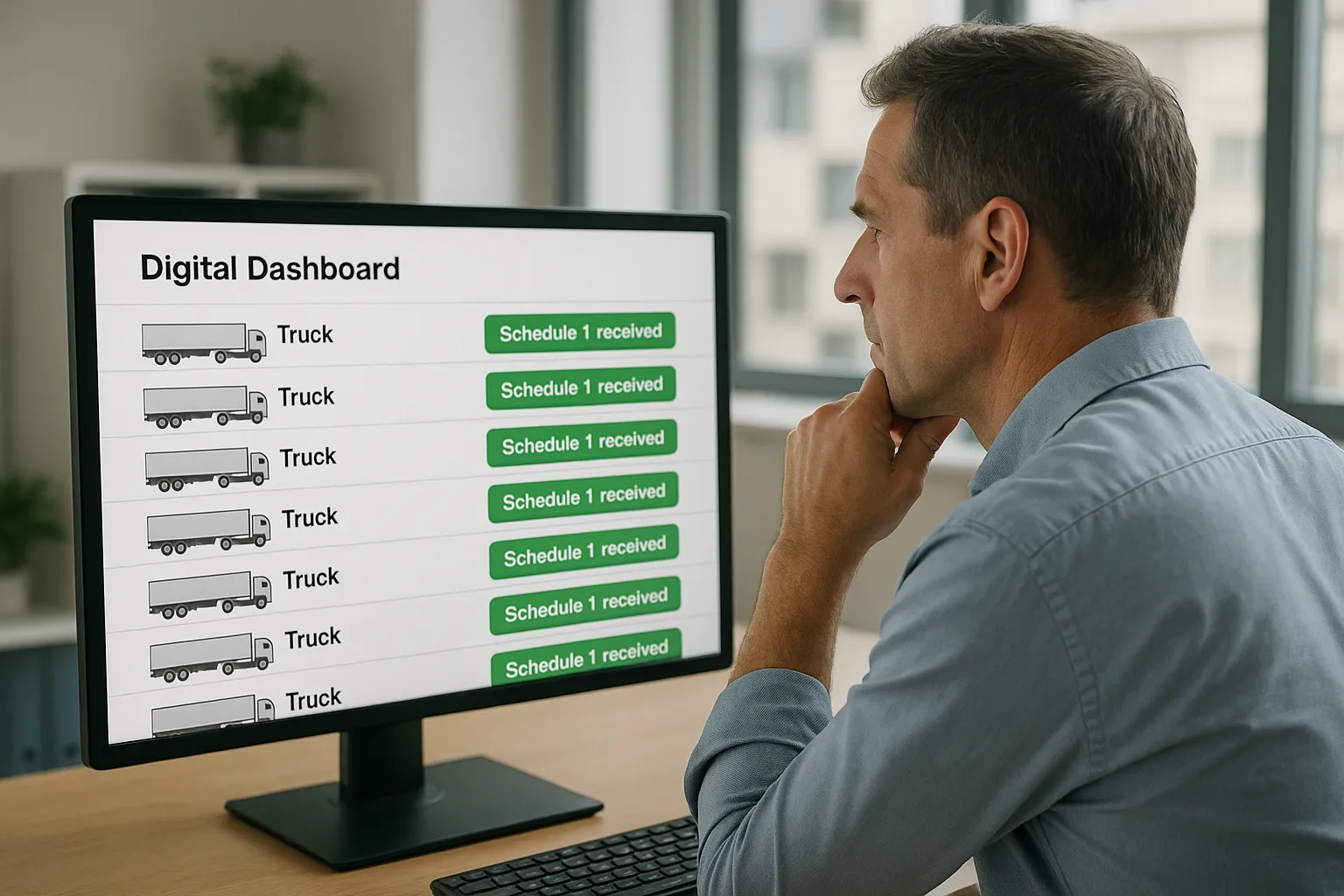

Receive Schedule 1 in your dashboard and email once the IRS accepts the file typically within minutes.

Built-in extras that save time all year

-

Free VIN correction e-filing if you fat-finger a character (learn more in our VIN correction guide).

-

Amendment wizard for weight increases or mileage limit exceedance, explained step by step in the Form 2290 amendments article.

-

Instant Schedule 1 retrieval anytime you need a fresh copy for a roadside inspection.

-

Bilingual support (English and Spanish) by phone, chat, or email ideal for mixed-language fleets.

Paper filing vs. e-filing at a glance

| Aspect | Paper submission | Simple Form 2290 e-file |

|---|---|---|

| IRS processing time | 4–6 weeks | Average < 5 minutes |

| Must stand in line at the bank or post office | Yes | No |

| Risk of handwritten errors | High | Low (real-time validation) |

| Schedule 1 delivery method | Physical mail | Email + dashboard download |

| Tracking IRS status | None until mail returns | Real-time updates |

| Cost to file | Postage + potential prep fees | USD 9.95 per truck |

Common filing scenarios solved online

-

New truck purchase mid-year. Use the Simple Form 2290 wizard to create a partial-period return starting the month you put the vehicle on the road.

-

Fleet bulk upload. Dispatchers can paste VIN lists or upload a CSV, saving hours during renewal season.

-

Credit for stolen or destroyed vehicles. The portal walks you through Schedule 6 of Form 8849 to request refunds, as covered in our Form 2290 refund guide.

-

Suspended vehicles under 5,000 miles. Declare Category W status with a single checkbox (details in the Category W article).

Filing deadlines you cannot ignore

The annual HVUT season runs from July 1 to June 30, and it’s surprisingly easy to mess up the deadlines if you’re not paying attention one of the most common Form 2290 mistakes to avoid while filing online. Returns and payments are due by the last day of the month after your vehicle’s First Used Month. So if you first hit the road in July, your due date is August 31. Miss that, and the IRS can slap you with penalties of up to 4.5% of the tax due, plus interest not exactly the kind of surprise anyone wants. (see our penalty avoidance tips).

Simple Form 2290 sends free email reminders each season so you never miss a cut-off date, whether you operate one rig or 500.

Pricing built for owner-operators and fleets

-

Single truck: USD 9.95 flat.

-

2–24 trucks: Automatic volume discount.

-

25+ trucks: Custom fleet pricing and dedicated account manager.

There are no hidden transmission, retrieval, or phone support fees. You preview the total before transmitting to the IRS.

Getting started today

-

Visit SimpleForm2290.com and click Sign Up (it takes less than a minute).

-

Gather your EIN, VINs, and gross weights. If you need a refresher on weight categories, see our guide to Form 2290 Category V.

-

Follow the on-screen steps. Live chat support is available if any IRS terminology is unclear.

-

Pay the low filing fee, transmit, and watch for the acceptance email. Your stamped Schedule 1 will be attached as a PDF.

Whether you are an owner-operator who hauls coast to coast or a fleet manager overseeing hundreds of power units, Simple Form 2290 delivers the fastest, cheapest, and most reliable path to HVUT compliance. Skip the envelopes, skip the stress, and keep your trucks and your cash flow rolling.