A delayed tax refund can squeeze cash flow for owner-operators and fleet managers who plan fuel, insurance, and maintenance around expected deposit dates. Understanding what is normal, what triggers an IRS Delay, and how to respond can protect your working capital and keep your trucks on the road.

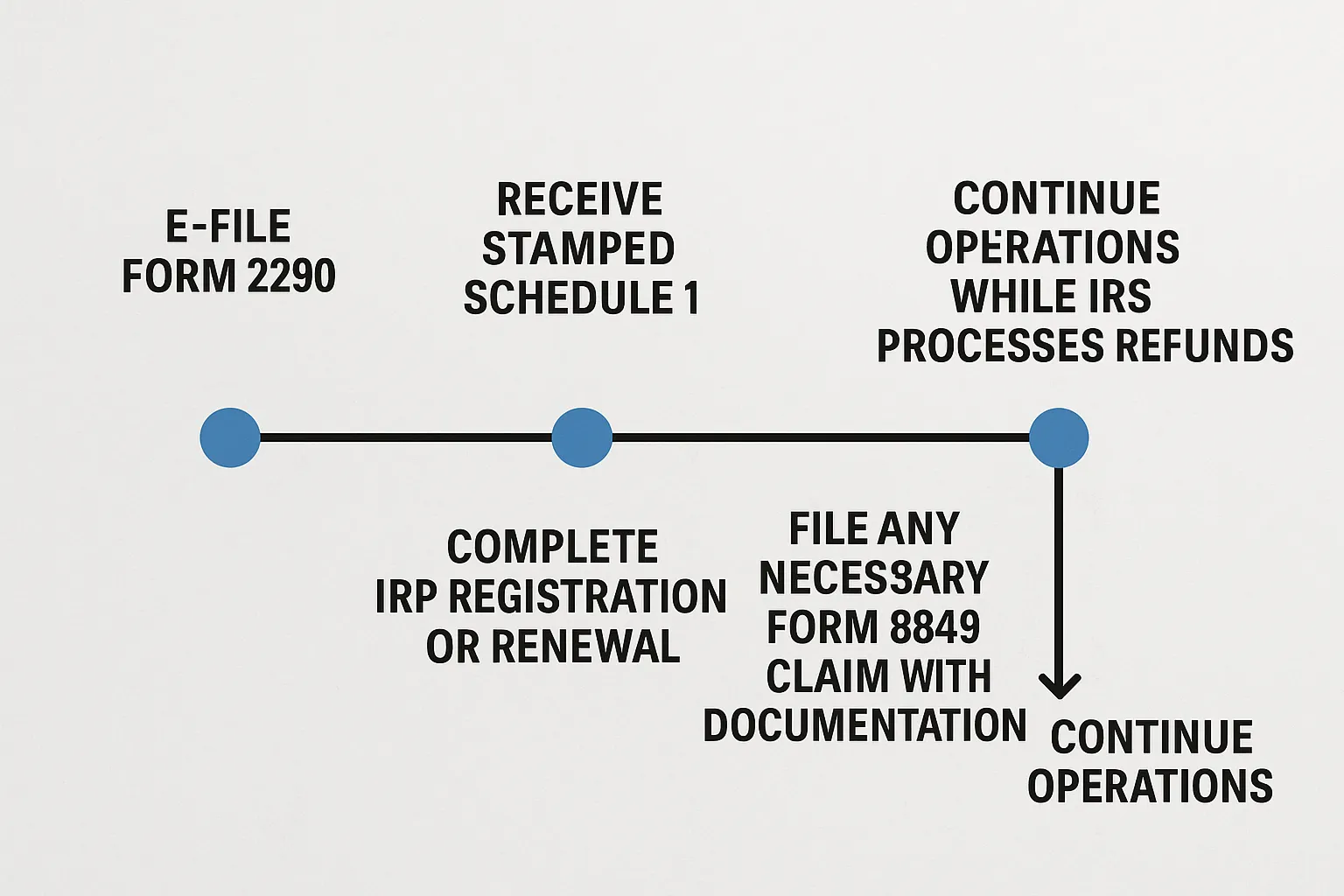

Below is a concise playbook, grounded in current timelines and best practices, plus practical steps to keep IRP truck registration and operations moving even if a refund takes longer than expected.

Refund timelines at a glance

Not all IRS refunds are the same. Timelines vary by form, filing method, and whether the return triggers additional review.

| Refund or acknowledgment | Typical timeline | What can slow it down | What to do |

|---|---|---|---|

| E-filed Form 1040 with direct deposit | About 21 days for 9 out of 10 refunds (per IRS) | Identity verification, math or data mismatches, certain credits under review | Use IRS Where’s My Refund daily, choose direct deposit, ensure data accuracy |

| Paper-filed Form 1040 | Often 6 to 8 weeks or more | Mail handling, manual data entry, peak-season backlog | E-file next time and use direct deposit |

| Form 8849 excise refund (Schedules 2, 3, 8) | Around 20 days | Missing documentation, VIN or schedule mismatches | File electronically with complete proofs, see Form 8849 refund claim processing times |

| Form 8849 excise refund (Schedules 1, 5, 6) | Around 45 days | Additional IRS review or documentation checks | Attach evidence up front and monitor mail for IRS letters |

| Form 2290 Schedule 1 acknowledgment | Usually minutes after IRS acceptance when you e-file | New EIN not yet active in IRS e-file systems, name control mismatch, last-minute peak traffic | EFile Form 2290 early with an IRS Authorized E-file Provider, confirm EIN and name control |

Processing times are estimates, not guarantees. During peak seasons or additional review, the IRS may take longer.

Why IRS Delay happens

Several factors consistently extend refund timing. Knowing them helps you head off trouble before it starts.

- Identity verification flags: If the IRS suspects identity theft or needs to verify your identity, you may receive Letter 5071C or 4883C. After you verify, processing can take additional time. See the IRS guidance on identity verification.

- Data mismatches or math errors: Name or EIN mismatches, incorrect SSN, W-2 or 1099 discrepancies, or Marketplace Form 1095-A issues can trigger manual review.

- Credits that require extra review: Some refundable credits are held for additional checks, especially early in filing season.

- Paper filings: Mail handling and manual entry add weeks compared to e-file.

- New EINs and name control issues for 2290: New EINs can take days to a couple of weeks to activate in IRS e-file systems. Name control mismatches can also block instant acceptance.

- Excise refunds without documentation: For Form 8849, missing proofs for sold, destroyed, or stolen vehicles, or VIN errors, are common reasons for review.

2025 IRS refund delay update, what we are seeing

- E-file with direct deposit remains the fastest route for individual refunds, and the IRS advises checking Where’s My Refund once per day since it updates overnight.

- Excise tax refunds via Form 8849 continue to run on a separate track. Plan for roughly 20 days for Schedules 2, 3, and 8, and roughly 45 days for Schedules 1, 5, and 6, assuming documentation is complete at submission.

- For trucking businesses, the critical difference is that your Form 2290 Schedule 1 is not a refund. It is your proof of HVUT payment and it typically arrives within minutes after IRS acceptance when you e-file, which keeps IRP truck registration and renewals on schedule even if a separate income tax refund is delayed.

Strategic moves to shorten or avoid delays

- E-file and choose direct deposit: For 1040 refunds, e-file plus direct deposit is the fastest combination. For 2290, e-file to receive your stamped Form 2290 Schedule 1 fast.

- Align IDs and names: Match EIN or SSN, legal name, and name control exactly as the IRS has it on file. Small typos cause big delays.

- Verify new EINs before peak deadlines: If you recently obtained an EIN, wait until it is active in IRS e-file systems before submitting Form 2290 or build in extra lead time.

- Attach complete evidence for Form 8849: Include bills of sale, police reports, or insurance settlements for sold, destroyed, or stolen vehicles, along with VINs and dates. Incomplete claims often sit the longest.

- Monitor status proactively: Use IRS Where’s My Refund for 1040 refunds and watch your mail for any IRS identity verification letters. Respond promptly to avoid weeks of added processing.

- Avoid paper unless required: Paper returns and mailed checks introduce the most variability and the longest wait times.

- File early relative to operational deadlines: For fleets, e-file 2290 well before renewal windows so IRP registration is never at risk while you wait on any separate refunds.

Side-by-side comparisons and lessons learned

- Scenario A, e-filed refund vs paper: An owner-operator e-files a clean Form 1040 with direct deposit and sees a refund in about 3 weeks. A similar driver mails a paper return and waits 6 to 8 weeks or more. Lesson learned, switching to e-file plus direct deposit is the single biggest time saver.

- Scenario B, Form 8849 with and without documentation: A fleet files Form 8849 Schedule 6 with detailed VIN lists and proof of sale for trucks disposed of mid-season, refund arrives inside the typical window. Another fleet uploads a claim with missing VIN proofs and receives an IRS letter requesting evidence, which adds several weeks. Lesson learned, meticulous documentation reduces review time.

For a deeper overview of schedules and expected windows, see this guide to Form 8849 refund claim processing times.

Keep IRP moving while refunds are pending

Income tax refund timing does not control your ability to keep registrations current. IRP jurisdictions typically require your current HVUT proof, which is your stamped Form 2290 Schedule 1. When you e-file with Simple Form 2290, your Schedule 1 is delivered to your dashboard and email as soon as the IRS accepts the return, usually within minutes. That means you can renew plates or complete IRP truck registration while any unrelated refund is still processing.

If you need a refresher on what qualifies for a 2290 credit or refund, this overview explains common cases and what to attach, such as stolen or destroyed vehicles, duplicate payments, or credit carryovers, see our guide to Form 2290 refunds and credits.

Action checklist to minimize IRS Delay

- Confirm IDs, names, and name control exactly as registered with the IRS.

- E-file everything you can and select direct deposit for refunds.

- For 8849 claims, attach proof up front, dates, VINs, and explanation.

- Track status daily using official IRS tools, and respond quickly to any letters.

- Build in calendar buffers around IRP renewals, permit deadlines, and seasonal demand.

How Simple Form 2290 helps

Simple Form 2290 is an IRS Authorized E-file Provider built for truckers and fleets. With our easy online filing portal, step-by-step guidance, and instant Schedule 1 delivery after IRS acceptance, you can EFile Form 2290, keep compliance tight, and focus on operations. Features include bulk vehicle filings, secure data storage, bilingual support, and a fleet dashboard that simplifies renewals and amendments. If you are facing a credit or refund situation, start with documentation and timing, then file confidently.

- Start now, file online in minutes, and get your stamped Form 2290 Schedule 1 as soon as the IRS accepts, visit Simple Form 2290.

- New to e-filing Form 2290, follow our step-by-step walkthrough, How to file Form 2290.

Final word

Smart planning beats waiting. Understand typical timelines, anticipate why IRS Delay happens, and file with complete, accurate information. Keep IRP truck registration current by securing your Form 2290 Schedule 1 early, and use documentation discipline to keep Form 8849 claims inside expected windows. With Simple Form 2290, you can protect cash flow and uptime while the IRS does its work.